Mastering Day Trading in Forex: Strategies, Tips, and Tools

Day trading in the Forex market presents a unique opportunity for traders to capitalize on short-term price movements. With the right strategies, discipline, and tools, anyone can become a successful day trader. If you’re considering diving into the world of Forex, this guide will equip you with essential knowledge and insights that can enhance your day trading experience. One of the crucial elements of successful trading is choosing the right broker. For example, you can find some of the day trading in forex Best Cambodian Brokers who can support your trading journey.

Understanding Day Trading in Forex

Day trading involves buying and selling currency pairs within the same trading day. Unlike long-term trading, where investors might hold onto assets for weeks or months, day traders typically seek to capitalize on small fluctuations in price. The Forex market operates 24 hours a day, allowing day traders to react quickly to market changes and news events that can impact currency values.

Key Principles of Day Trading

Successful day trading requires a solid understanding of several key principles:

- Risk Management: One of the most critical components of day trading is effective risk management. Traders should only risk a small percentage of their capital on each trade to protect their overall portfolio.

- Market Analysis: Day traders must continually analyze market trends and data. This can involve technical analysis, using charts and indicators, as well as fundamental analysis, monitoring economic news and events.

- Discipline: Emotional trading can lead to significant losses. It’s essential for day traders to stick to their established trading plan and avoid impulsive decisions.

- Time Management: Day traders often spend significant amounts of time in front of their screens, monitoring price movements and adjusting their strategies in real-time. Effective time management can improve productivity and efficiency.

Essential Strategies for Day Trading

There are several strategies that can be effective for day trading in Forex:

1. Scalping

Scalping involves making numerous trades throughout the day to capture small price changes. Scalpers typically hold positions for just a few minutes or even seconds, requiring a highly disciplined approach and quick decision-making.

2. Momentum Trading

This strategy focuses on trading based on the momentum of currency pairs. Traders identify currencies that are moving significantly in one direction and take positions in the same direction, hoping to profit from the continuation of that movement.

3. Breakout Trading

Breakout trading involves identifying key support or resistance levels and placing trades when the price breaks through these levels. This can lead to explosive price movements, offering substantial profit opportunities.

4. Range Trading

Range trading is based on identifying periods of consolidation in which prices move within a defined range. Traders place buy orders at support levels and sell orders at resistance levels, capitalizing on price reversals within that range.

Tools and Resources for Day Traders

To succeed in day trading, having the right tools at your disposal is essential. Here are some of the must-have resources:

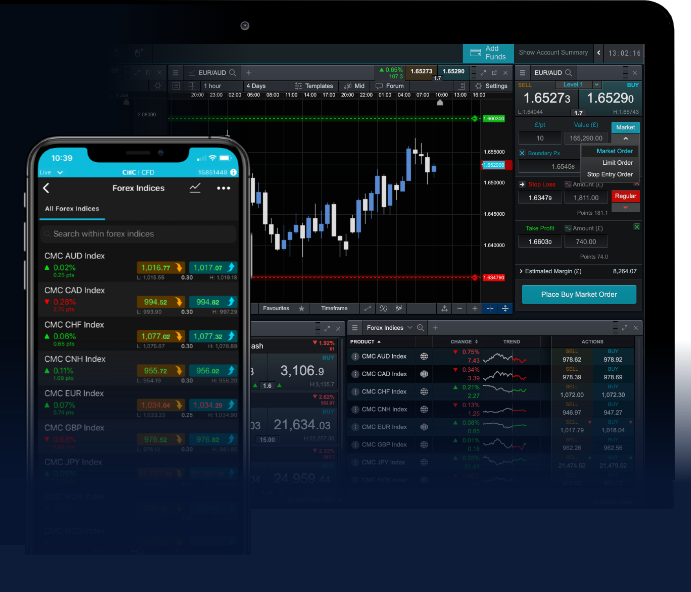

- Trading Platforms: A good trading platform allows for smooth execution of trades and access to various charting tools. Look for a platform that offers advanced features, including real-time data, technical analysis tools, and automated trading options.

- Technical Indicators: Indicators such as moving averages, MACD, and RSI can help traders analyze price movements and identify potential entry and exit points.

- Economic Calendars: Staying updated on economic events is vital for Forex day traders. Economic calendars provide information about upcoming news releases that can affect currency prices, allowing traders to prepare accordingly.

- Demo Accounts: Before committing real money, many brokers offer demo accounts where traders can practice their strategies without risk. This is a great way to get accustomed to the trading platform and test your trading plan.

Common Mistakes to Avoid

Even experienced traders can make mistakes that lead to losses. Here are a few common pitfalls to watch out for:

- Overleveraging: While leverage can increase profits, it can also amplify losses. Traders should use leverage cautiously and understand its implications before employing it.

- Lack of a Trading Plan: Trading without a clear plan can lead to emotional decision-making. Every trader should have a well-defined plan that outlines their goals, strategies, risk tolerance, and money management rules.

- Ignoring Market Conditions: Market conditions can change rapidly. It’s essential for traders to stay informed and adjust their strategies based on the current environment.

- Over-trading: Engaging in too many trades can lead to burnout and unnecessary losses. Traders should be selective with their trades and focus on quality over quantity.

Conclusion

Day trading in Forex can be both rewarding and challenging. By understanding the fundamental principles, employing effective strategies, and utilizing the right tools, traders can improve their chances of success. Remember that day trading requires a significant time investment, discipline, and a willingness to learn from both successes and setbacks. As you embark on your trading journey, consider working with a reputable broker and continuously honing your skills through education and practice.

Discussion about this post